Return on Net Assets (RONA): Definition, Formula & Calculation

Return on net assets (RONA) is used to measure the effectiveness of capital usage and allocation. It measures how well a company manages its assets.

In simple terms, RONA tells us how much profit a company generates from every dollar of assets it owns.

It helps investors understand the financial strength of a firm and its ability to operate efficiently. A high RONA score shows that a company is using its assets effectively, whereas a low RONA score indicates that further improvement is necessary.

Let’s take a deeper look into what RONA means and why it’s important for you as an investor.

Table of Contents

KEY TAKEAWAYS

- Return on net assets (RONA) is a financial ratio that measures a company’s efficiency at generating profits from its total assets.

- The return on net assets ratio is calculated by dividing a company’s net income by its total assets.

- A company with a higher RONA is considered to be more efficient at turning its assets into profits than a company with a lower RONA.

What Is Return on Net Assets (RONA)?

RONA is the company’s net profit as a percent of its net assets. Net assets are the company’s total fixed assets minus its current liabilities.

While the earnings yield is always calculated on the company’s earnings per share (EPS), the RONA is calculated on the basis of the company’s net current assets. This doesn’t include its current liabilities, as RONA doesn’t take into account the amount of debt a company has.

This makes it a better indicator of how efficiently a company can generate profits from its assets. But it also means that it doesn’t take into account a company’s overall financial performance.

A company needs strong profit performance to generate a good asset return. This is a major asset component that investors look at. In other words, the RONA is a profitability ratio. It tells investors how much profit a company generates from every dollar of assets it owns. But it doesn’t consider the return on assets.

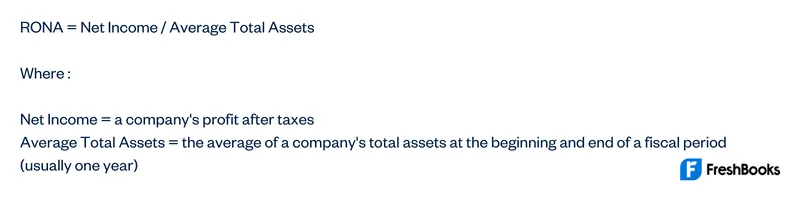

Return on Net Assets Formula

The return on net assets (RONA) ratio is a favorable metric that tells us how much profit a company generates for each dollar of net assets it has on its balance sheet. In other words, it’s a measure of how efficiently a company is using its assets to generate profits.

The ratio formula inputs for RONA are:

For example, let’s say Real Estate Company XYZ has net income of $100,000 and average total assets of $1,000,000. This gives us a RONA ratio of 10%.

This means that for every dollar of assets on its balance sheet, Real Estate Company XYZ generates 10 cents of profit.

The RONA ratio is a useful tool for investors because it allows us to compare the profitability of different companies, regardless of their size.

For example, imagine two companies. Company A has a net income figure of $1,000,000 and average total assets of $10,000,000. Company B has net income of $100,000 and average total assets of $1,000,000.

At first glance, it might appear that Company A is more profitable than Company B. However, when we calculate their RONA ratios, we find that Company A has a ratio of 10% while Company B has a ratio of 10%.

This means that both companies are equally efficient in terms of using their assets to generate profits.

The RONA ratio is a popular performance metric among investors. It’s a simple and effective way to compare the profitability of different companies.

However, it’s important to keep in mind that the RONA ratio is just one tool in an investor’s toolbox. It should be used in conjunction with other financial ratios and metrics in order to get a complete picture of a company’s financial health.

How to Calculate RONA

There are two steps in calculating a company’s RONA ratio:

1. Calculate the company’s net income: This can be found on a company’s income statement.

2. Calculate the company’s average total assets: This is done by taking the average of the total assets at the beginning and end of a fiscal period (usually one year).

Using a similar example, let’s say Company XYZ has net income of $100,000 and total assets of $1,000,000 at the beginning of the year. At the end of the year, its total assets are $1,200,000. This gives us an average total assets figure of $1,100,000.

Now that we have all the necessary information, we can plug it into the simple formula and calculate the company’s RONA ratio.

RONA = Net Income / Average Total Assets

RONA = $100,000 / $1,100,000

RONA = 9.09%

This means that for every dollar of assets on its balance sheet, Company XYZ generates 9.09 cents of profit.

Advantages of RONA

A high RONA is a positive indicator that the company is using its physical assets effectively. This can be a sign of good management and indicates that the company should be able to generate profits in the future.

RONA doesn’t include debt in the calculation so it’s a better indicator of how efficiently a company can generate profits from its assets. It measures how well a company manages its physical assets.

Let’s assume an imaginary company has a low RONA. It may mean that it’s inefficiently using its physical assets. Or even that it has too much debt. If a company has a high RONA, it may mean that it has too little debt, which could put it at risk of losing customers, suppliers, and investors.

A low RONA could mean that the company needs to improve its management of assets or take on more debt.

Disadvantages of RONA

The RONA ratio doesn’t take into account the company’s overall financial strength, which is why it’s not a good way to determine if a company is financially healthy.

It doesn’t include debt in the calculation. This means it’s a better indicator of how efficiently a company can generate profits from its physical assets. But it does so without considering overall financial strength.

Example of RONA

ABC Company is a widget manufacturer. It has net income of $200,000 and total assets of $2,000,000. Its RONA ratio would be calculated as follows:

RONA = Net Income / Average Total Assets

RONA = $200,000 / $2,000,000

RONA = 10%

This means that for every dollar of assets on its balance sheet, Company ABC generates 10 cents of profit.

The generation of these expenses over time ensures a positive metric for capital gain. This residual income reflects the company’s profit potential.

Summary

The RONA ratio is the company’s net profit after taxes as a percent of its net assets. It’s a profitability ratio that tells investors how much profit a company generates from every dollar of assets it owns.

A high RONA is a positive indicator that the company is using its assets effectively and generating significant profits from them.

Keep in mind that the RONA doesn’t take into account a company’s overall financial health. It doesn’t include debt, meaning it’s a better indicator of how efficiently a company can generate profits from its assets. But it also means that it doesn’t consider financial strength.

FAQs About Return on Net Assets

No. While both ratios are measures of profitability, they focus on different things. ROCE looks at capital, while RONA looks at assets.

Both ratios are measures of profitability. The primary difference is that RONA is more specific than ROA. ROA looks at all assets, while RONA only looks at net assets.

Both ratios are measures of profitability. But the biggest difference is that RNOA is more specific than ROE. ROE looks at all equity. RNOA only looks at net operating assets, such as costs of operation.

Share: