Return on Equity (ROE), Definition, Formula & Example

It’s important for both investors and business owners to understand how to measure financial performance.

There are a number of key things that can be revealed by looking at how successful a business is performing financially. It can give valuable insight into the likelihood of success, as well as give a useful indication of how strong an investment the business may be.

One way of measuring financial performance is by return on equity.

But what exactly is the return on equity? And how can you use it to your advantage? Read on as we provide you with everything you’ll ever need to know about return on equity. As well as answer some of your frequently asked questions.

Table of Contents

KEY TAKEAWAYS

- One way of measuring financial performance is by return on equity.

- It can be calculated by dividing shareholder equity by the net income of the company in question.

- ROE shows a business’s profitability.

- It also gives an indication of how efficient it is at generating profits.

- A number of factors can affect the ROE, such as which industry the business is operating in.

What Is Return on Equity?

Return on equity is a financial performance measure. It works by dividing shareholder equity by the company’s net income. It gives you an idea of the business’s profitability as well as how efficiently the business generates its profits.

What Is the Formula For Return on Equity?

Return on equity is shown as a percentage. It can be calculated for any company that has positive numbers for both income and equity. The net income has to be calculated before dividends are paid to common shareholders. As well as after interest is paid to lenders and dividends to preferred shareholders.

The best way to calculate Return on Equity is to base it on the average equity over a certain period of time. This is because there is often a mismatch between the balance sheet and the income statement.

The formula for return on equity is straightforward:

What Is Net Income?

A business’s net income is the amount of income, net expenses, as well as taxes a company generates. This is for any given period of time. Net income is found on a business’s income statement and is recorded over twelve months.

What Is the Average Shareholders’ Equity?

The average shareholders’ equity can be calculated by adding equity at the beginning of the given period that you’re calculating your RoE. Both the beginning and the end of this period should marry up with the time that net income is earned. Shareholders’ equity can be found on a business’s balance sheet. It is a running balance of the entire company’s history of what changes have occurred in their assets and liabilities.

An Example of Return on Equity

Let’s say that Company X has an annual income of $180,000. The average shareholders’ equity for this period of time is $1.2 million. So by using the above formula, we can use this information to calculate Company X’s return on equity.

RoE = $180,000 / $1,200,000

So:

RoE = 0.15

This calculation shows that the return on equity is 0.15. But as RoE is presented as a percentage, the RoE would be shown as 15%.

In terms of investment, a 15% return on equity would equate to a decent return.

However, let’s say that the annual income of Company Y is also $180,000. But the average shareholders’ equity for this period of time is $2.4 million. By using the same formula, we can use this new information to calculate Company Y’s return on equity.

RoE = $180,000 / $2.4 million

So:

RoE = 0.075

This would mean that the RoE is only 7.5%. This is still a positive return. Yet it is considerably lower than the RoE of Company X. This means that Company X would be considered a more valuable company to invest in.

What Can Return on Equity Be Used For?

You would be forgiven for thinking that the higher the return on equity, the better. But this is not always the case. A business could have an RoE that is double, quadruple, or even higher than the average return of others in the same industry. But that doesn’t necessarily mean that they are a more valuable investment.

While a very high RoE can be a good thing, this is only under specific circumstances. That is when net income is large compared to the equity, because of the strong performance of the company. But if RoE is high due to small equity in comparison to net income, this can indicate risk.

In almost every case, negative or very high RoE levels can be considered a warning sign. There are some uncommon cases where a negative RoE could be explained. It could be down to the fact that a share buyback supported by a strong cash flow is paired with excellent management. But this is an unlikely outcome.

Let’s take a look at some of the reasons why a high RoE isn’t always a positive thing.

An Excess of Debt

When a company has excess debt, it can cause a higher RoE. So if a business has been aggressively borrowing, it can boost the RoE. This is because equity is equal to assets, minus debt. So when a company has more debt, equity can fall much lower.

The most common scenario is if a business borrows a large amount of debt to buy back its own stock. This, therefore, inflates their earnings per share. But it doesn’t affect growth rates or performance.

Inconsistent Profits

Another issue with having a high RoE can be inconsistent profits. So let’s say that a company has been unprofitable for a long period of time. Each year, the losses are recorded on the balance sheet. They are recorded in the equity portion as a retained loss. These losses would show as a negative balance and therefore reduce the shareholders’ equity.

If the company then has a windfall it would return to profitability. That would mean that the average shareholders’ equity in the calculation is now small after the previous years of losses. This would make the RoE high, but misleadingly so.

Negative Net Income

A high RoE can also be created due to a negative shareholders’ equity as well as a negative net income. But this shouldn’t actually ever be an issue. As if a business has a net loss or a negative shareholders’ equity, then RoE shouldn’t be calculated.

The most common issue when the shareholders’ equity is negative is excessive debt. It could also be due to inconsistent profitability. But this isn’t always the case. An exception is when a business is profitable and has been using its cash flow to buy back its own shares. This is an alternative to paying dividends and can reduce equity enough to turn the calculation into a negative.

What Is a Good Return on Equity?

A good RoE will depend on the industry that the business is in. As well as who their competitors are. To take the S&P 500 into consideration, their average has been around 18-19%. But different companies in different industries can be much higher or much lower.

A highly competitive industry will have companies with a lower RoE. And industries with little competition will have limited assets to generate revenue. So they would most likely have businesses with a higher average RoE.

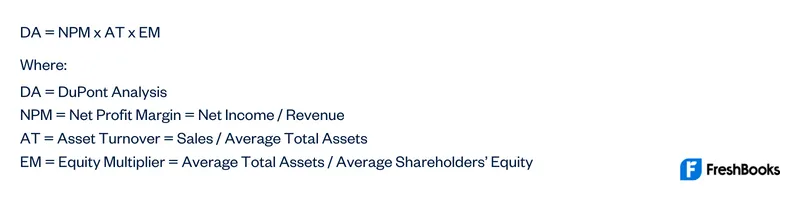

What Is the DuPont Formula?

The DuPont formula is also known as the strategic profit model. It is used as the framework for analyzing fundamental performance. It is used to decompose the different drivers of return on equity.

The formula for this profit model is as follows:

Summary

Return on equity is a very important financial metric. Investors can use it to figure out how efficient management is, and compare the net income to the equity of the business. It can be complicated to figure out what a good RoE is. Generally speaking, the higher the better. But when it is too high it can show a high level of risk. The bottom line is that it will always depend on what industry the business is in.

It’s important to note that investments are inherently risky. That means that you shouldn’t only use one metric when determining whether or not to invest. Using a variety of financial metrics will give you a much better understanding of the financial health of a company. And this is important to do before equity investment.

FAQs About Return on Equity

The rate of return is also a financial ratio. It is used to figure out how much you’ve made from a specific investment over a period of time. This is in comparison to return on equity. This is a calculation specific to stocks. It calculates how much money is made based on the shareholders’ investment in the business.

Return on investment is a financial metric that focuses on the clearing profits of the business. This is in comparison to return on equity. This is a calculation specific to stocks. It calculates how much money is made based on the shareholders’ investment in the business.

The return on equity ratio and return on assets are two important measures. They both help to determine how efficient a company is when it comes to generating profits. The main difference is that return on assets takes leverage and debt into account. Return on equity doesn’t take this into consideration.

The RoE can be more than 100 if the income is greater than the equity.

Share: